We can help you every step of the way.

We’ll save you from all the stress of loan applications while saving you valuable time and money. A complete one-stop shop for your car finance needs!

Our car loan specialists will help you through the entire loan process, from navigating the minefield of lender requirements to negotiating and arranging the settlement with the lender.

Find great deals

Our experienced car loan specialists will help find you the best deals to save you money.

Don’t worry about bad credit

We can help find good value finance regardless of your circumstances or credit history.

Leading lenders

We select products from only the best lenders who meet out strict criteria for price, service and ethics.

Easy process

Our application process is streamlined, so in most cases, you can get your car loan immediately.

How to apply

CarLoans.com.au offers unparalleled convenience when applying for a variable rate car loan.

Our four-step streamlined process can get you behind the wheel sooner.

-

Tell us what you need by applying online or over the phone.

-

We'll find you the best finance available.

-

We'll arrange the application and the settlement.

-

Drive away in your new car!

What is a variable rate car loan?

As the name suggests, the interest rate for this type of loan changes based on market factors. Your interest rates will rise and fall based on the changing market and other factors determined by the lender.

Variable rate car loans have flexible features like extra repayments with redraw facilities and/or offset sub-accounts. These additional features can help you save on interest costs and pay off the car loan sooner.

Benefits of a variable rate car loan

The key benefit of a variable rate car loan is lower car loan rates when interest falls. You can take full advantage of lower rates and potentially save thousands over the life of the loan.

A variable rate car loan offers the following advantages:

-

More flexibility. You can pay your loan off sooner and save on interest costs.

-

Less fees and expenses. Usually, variable rate car loans have minimal or no early exit or early payment fees.

-

Variable rate car loans typically have lower rates compared to fixed rate car loans at the time of application.

Secured vs Unsecured variable rate car loans

Variable rate car loans can be secured or unsecured. Each option has its own pros and cons. Figuring out which one is best for you depends on your circumstances.

Secured variable rate car loan

When you take out a secured car loan, the vehicle you purchase will be used as collateral or a guarantee. This means that if you don’t make the necessary repayments, the lender can seize the vehicle and sell it to recoup the outstanding balance on your loan.

Because of the security, lenders usually offer lower rates on secured variable rate car loans compared to unsecured ones.

Unsecured variable rate car loan

An unsecured variable rate car loan is a loan where no asset is put up as collateral. The lender won’t be able to seize your car if you fail to meet the agreed-upon payments or default on the car loan.

Due to the lack of collateral, unsecured loans may have higher interest rates and fees.

What to Consider When Getting a Variable Rate Car Loan

Variable rate car loans vary from lender to lender. The ideal variable rate car loan for you will depend on your financial circumstances and what you want from your car finance. Before choosing a car loan, here are a few things you need to think about:

Interest rate

Even though variable rate car loans have fluctuating interest rates, it’s still a good idea to find a lender with competitive initial interest rates. Be sure to examine comparison rates that include the complete cost of the loan before applying.

Fees

Additional fees are often unavoidable. These include one-time expenses such as establishment fees, as well as recurring fees, and loan service fees. To be sure you're receiving a decent deal, compare fees in addition to interest rates and loan features.

Loan term

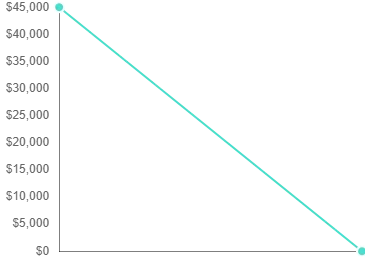

Variable rate car loans typically have a loan duration of one to seven years. The longer the loan term, the lower your repayments will be. However, a long loan term could also mean higher interest costs over the life of the loan. Check to see whether you can repay the loan over a time that fits your budget.

Minimum and maximum amounts

The minimum loan amount is $5,000 for a variable rate car loan while the maximum loan amount can vary widely amongst lenders. Some lenders don't have a maximum loan amount and instead, judge on a case-by-case basis. Keep this in mind while deciding which vehicle to purchase.

Additional payments

Some lenders allow you to make extra repayments to pay off your debt faster. Keep in mind that some lenders will charge fees if the loan is paid off early, so try to look for a loan that doesn't have these fees.

Additional loan features

Car loans come with a variety of features to help you manage them more effectively. Some lenders include cheap car insurance with their loans while others provide car-finding services.

Arrange a Call

Fill out the following details and one of our car loan specialists will be in contact.