We can help you every step of the way.

A complete one-stop shop for your car finance needs! We’ll save you from all the stress of loan applications while saving you valuable time and money.

Our car loan specialists will help you through the entire loan process, from navigating the minefield of lender requirements to negotiating and arranging the settlement with the lender.

Best possible deal

Our experienced car loan specialist will fight for you so you can save more.

Bad credit?

We can find you good value finance regardless of your personal circumstances or credit history.

Leading lenders

We offer loan products from only the best lenders who meet our strict criteria for price, service, and ethics.

Easy process

We take the hassle out of getting a car loan. Sit back and let us do all the hard work for you.

How to apply

CarLoans.com.au offers unparalleled convenience when applying for a fixed rate car loan.

Our four-step streamlined process can get you behind the wheel sooner.

-

Tell us what you need by applying online or over the phone.

-

We'll find you the best finance available.

-

We'll arrange the application and the settlement.

-

Drive away in your new car!

What is a fixed rate car loan?

This is a car loan where the interest rate stays the same throughout the loan term. Fixed rate car loans are unaffected by outside market factors or rate changes, so your car loan repayments won’t change with the rise or fall of interest rates.

Fixed rate car loans are one of the most common car finance options. Because of the fixed rate, many borrowers find managing this type of loan easier. The consistency and predictability of repayment amounts make repayments more straightforward.

Benefits of a fixed rate car loan

The key benefit of a fixed rate car loan is the unchanging car loan rates. You’ll know exactly how much your loan is going to cost.

A fixed rate car loan offers the following advantages:

-

No worrying about rate hikes. You don’t have to adjust your budget in case there interest rates increase.

-

More manageable car loan. The predictable and consistent repayment amount makes it easy for borrowers to keep up with payments.

-

You plan your budget months in advance. You can keep your finances in check and

Secured vs Unsecured fixed rate car loans

When taking out a fixed rate car loan, you could choose between secured or unsecured finance. It’s important to weigh your options carefully as each one has its own benefits and drawbacks.

Secured fixed rate car loan

In a secured fixed rate car loan, the vehicle you purchase using the loan will be used as collateral. If you don’t make the repayments or default on your car finance, the lender will be able to repossess the car.

Lenders usually offer lower rates on secured fixed-rate car loans because of the added guarantee.

Unsecured fixed rate car loan

With unsecured fixed rate car loans, there is no asset put up as collateral or security. If you don’t make your loan repayments, the lender won’t be able to seize your car or any other asset. However, lenders may opt to take legal action to recover the outstanding loan balance.

Because there’s no collateral, unsecured fixed rate car loans usually have higher interest rates and more stringent terms.

What to Consider When Getting a Fixed Rate Car Loan

Fixed rate car loans vary from lender to lender. The ideal fixed rate car loan for you will depend on your financial circumstances and what you want from your car finance. Before choosing a car loan, here are a few things you need to think about:

Interest rate

Because the interest rate for a fixed rate car loan is set for the entirety of the loan term, finding a competitive rate is essential. The lower the interest rates, the more you save on interest costs over the life of the loan. Examine comparison rates to see the complete cost of the loan before applying.

Fees

Additional fees are often unavoidable. These include one-time expenses such as establishment fees, as well as recurring fees, and loan service fees. To be sure you're receiving a decent deal, compare fees in addition to interest rates and loan features.

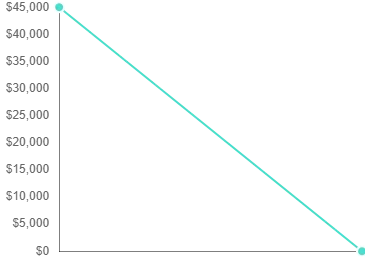

Loan term

Fixed rate car loans typically have a loan duration of one to five years. The longer the loan term, the lower your repayments will be. However, a long loan term could also mean higher interest costs over the life of the loan. Check to see whether you can repay the loan over a time that fits your budget.

Minimum and maximum amounts

The minimum loan amount is $5,000 for a fixed rate car loan while the maximum loan amount can vary widely amongst lenders. Some lenders don't have a maximum loan amount and instead, judge on a case-by-case basis.

Additional payments

Some lenders allow you to make extra repayments to pay off your debt faster. Keep in mind that some lenders will charge fees if the loan is paid off early, so try to look for a loan that doesn't have these fees.

Additional loan features

Car loans come with a variety of features to help you manage them more effectively. Some lenders include cheap car insurance with their loans while others provide car-finding services.

Arrange a Call

Fill out the following details and one of our car loan specialists will be in contact.