We can help you every step of the way.

We’ll save you from all the stress while saving you valuable time and money too—a complete one-stop shop! Our car loan specialists are here to help, from navigating the minefield of lender requirements to negotiating and arranging the settlement with the lender.

Find great deals

Our experienced car loan specialists will help find you the best deals to save you money.

Don’t worry about bad credit

We can help find good value finance regardless of your circumstances or credit history.

Leading lenders

We select products from only the best lenders who meet our strict criteria for price, service and ethics.

Fast loan approval

Simply submit all your required documents and get approved quickly.

How to apply

CarLoans.com.au’s hassle-free loan process.

Our four-step process saves you time and gets you into your new loan quickly.

-

Describe your needs and apply online or over the phone.

-

We'll find you the best refinance options available.

-

We'll arrange the application and the settlement.

-

Start making repayments on your new loan!

What is a car loan refinance?

When you refinance a car loan, you’re switching between lenders. You’ll exit your current loan agreement and enter a new one with another lender. Since you’ll be terminating your existing loan prematurely, you’re expected to pay break fees and other associated costs, as well as application fees on your new loan.

Car loan refinance is ordinarily best for those whose financial situation has changed significantly since applying for their current loan. Borrowers also typically refinance their car loans to take advantage of lower interest rates or change their repayment structure.

Because there’s so much involved in car loan refinance, it’s best to consider all your options before applying. Discussing your car loan needs with your lender or finance broker can help you figure out the best finance solution.

Benefits of a car loan refinance

If you’re not satisfied with your current car loan, refinancing allows you to change lenders so you can find one that fits your needs better. In addition to this, car loan refinance also offers the following advantages:

-

You can get better interest rates. If interest rates have dropped a lot since taking out your current loan, refinancing could save you more in the long run.

-

Add or remove co-signers. Adding or removing co-signers could be beneficial depending on what you want out of your car loan.

-

Change repayment frequency. Modifying the payment structure can help you manage your car loan more easily. If you’re making more frequent payments, it can save you on interest costs, as well.

-

Add loan features. Take full advantage of new loan features that weren’t available to you when you took out your current loan.

What to consider before refinancing your car loan

Car loan refinance options vary from lender to lender. The ideal car loan refinance for you will depend on your circumstances. Here are a few things to consider when assessing a car loan refinance offer.

Interest rates

The interest rates impact your regular repayments and vary among lenders. When refinancing a car loan, ideally, you would want the rates to be lower than those on your existing loan. Be sure to examine comparison rates that include the complete cost of the loan before applying.

Lenders

Every lender has their own unique car loan refinance offer. Some may have lower interest rates than others, but higher fees and vice versa. The goal is to find a new lender that fits your needs better and can provide better service overall. The easiest way to find the ideal lender is through a car finance broker like CarLoans.com.au.

Remaining loan term and outstanding balance

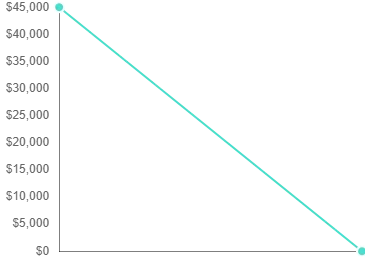

Ideally, a car loan refinance is done in the earlier years of a loan so you can get the full benefits of any changes, like a lower rate or a change in payment structure. If your car loan is ending soon and has very little balance remaining, refinancing it may not be as useful and could cost you more.

Exit fees and application fees

Refinancing a car loan involves more fees than the standard loan application. These can include exit fees, early payment fees, and break fees, as well as establishment fees and recurring fees on your new loan.

Current financial situation

Your current financial situation plays a crucial role in whether you should get a car loan refinance or not. Consider your finances carefully to see if refinancing is the right option for you.

Frequently Asked Questions

Arrange a Call

Fill out the following details and one of our car loan specialists will be in contact.