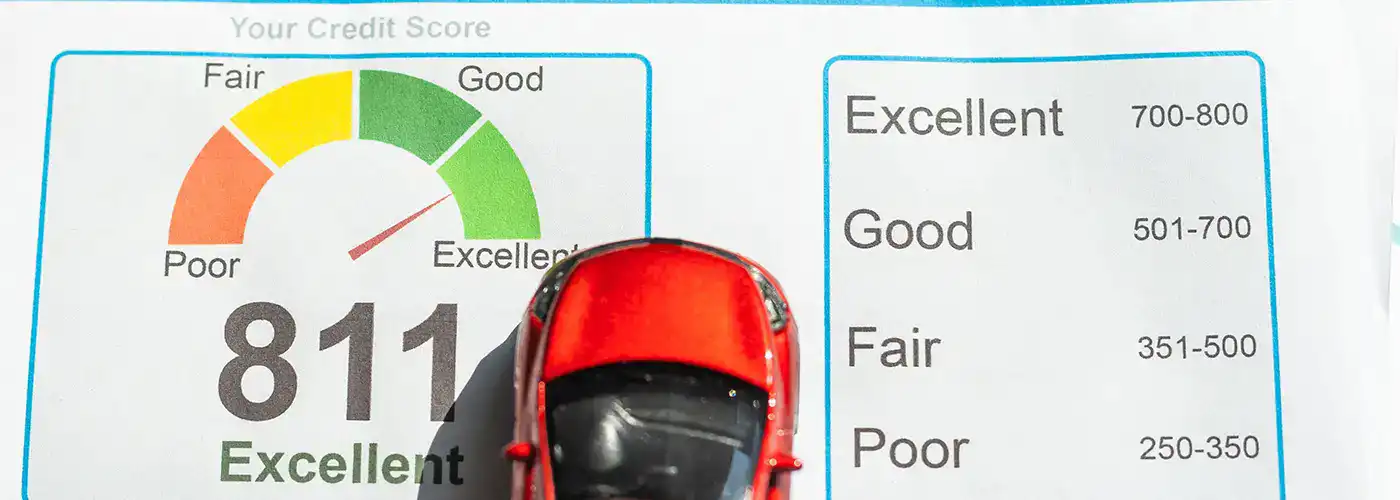

Your credit score impacts your car loan application more than you think. If you have good credit, you’re more likely to get your loan approved with good interest rates and terms. The opposite is true when applying for a car loan with bad credit.

If you want to get a car loan but have a bad credit score, it’s not the end of the world. You’re not cursed to a life of paying high-interest loans with unfavourable conditions. All you need to do is find ways to rebuild your credit. Here are some of the best ways to rebuild your credit quickly:

Review your credit report for discrepancies

This is one of the fastest ways to rebuild your credit. Request a full copy of your credit report from a credit bureau and double-check the information. Review the report entries carefully keeping an eye out for any mistakes.

Having inaccurate debt listed on your report can dock your credit by a few points. If you find any discrepancies, contact the credit provider immediately and have it corrected. Once everything is settled, your credit score will reflect the changes and boost your score.

If you’re having trouble settling the information dispute, get in touch with the Australian Financial Complaints Authority (AFCA).

Pay your bills and debts on time

Your credit score is impacted by the timeliness of your bill and debt payments. If you have a history of missed or late payments, it’s going to negatively impact your credit score. Although you can’t do anything about previous payments, you can still improve your credit by paying your future bills on time.

Set up automated bill payments through online banking to ensure you don’t miss payment deadlines. Or put reminders on your phone or calendar for credit card or loan payments. Not only will this help improve your credit, but it can also save you money on late fees and penalties. If you keep up the habit of timely bill payments, lenders are more likely to approve your car loan application. There are no downsides to paying your bills on time.

Resolve any outstanding debt and balances

Paying off whatever outstanding debt you can, be it credit card balances or loan payments, can help you improve your credit score. You could see quick results with this method based on your credit utilisation. If you’ve maxed out your credit limit and resolved your outstanding debt, your credit score will improve significantly.

Take note, paying off your debts is only effective if you use your own money for it. Using a debt refinance loan to pay for outstanding balances, for example, won’t boost your credit score. It’s best to save money to pay for your debts and keep a healthy credit rating. Increasing your savings is also a good way to improve your savings-to-debt ratio which a lot of lenders look at before approving loans.

Control your credit utilisation rate

Credit utilisation rate refers to the percentage of credit you’re using on your credit cards and other lines of credit. Generally, the lower your credit utilisation rate, the better it is for your credit score. Those with the highest credit score usually have very low utilisation rates. Keeping your credit utilisation at 30% or below is a great step towards rebuilding your credit score.

Your total credit is outlined in your complete credit report. Only your most recent limits and balances are included in the report. One of the fastest ways to rebuild your credit is by lowering your credit utilisation rate.

Monitor your lines of credit closely

You can use your credit to your advantage by either diversifying or limiting it. When you diversify your credit, you’re strengthening your creditworthiness which could improve your credit score. This is great for those who don’t have a lot of credit lines open. It might seem counterintuitive to get different types of credit, but this could be better for your credit score in the long run.

On the flip side, if you already have a healthy mix of credit cards and loans, avoid opening more lines of credit. Lenders conduct inquiries into your credit history when you apply for any loans or credit cards, which could reduce your credit score by a couple of points.

Let CarLoans.com.au find the perfect car finance for you!

At CarLoans.com.au, we can help you get the best low-rate car loan that meets your needs perfectly. If your credit is still not as good as you want it to be, don’t fret! We also have plenty of bad credit car loans that are made specifically for those who don’t have the best credit.

Get a quote today or talk to our friendly finance brokers by calling 1300 889 669.