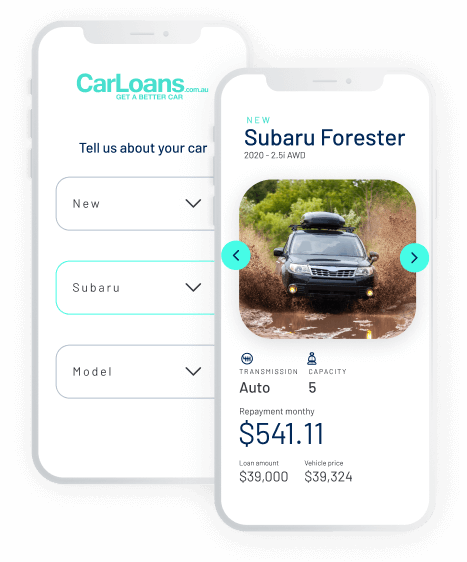

We're here to find the right finance for you.

At CarLoans.com.au, we've helped thousands of Australians get the right loan for them.

Why choose us?

At CarLoans.com.au, our car finance brokers have been helping customers find the best car loan offers in Australia since 2013. We’re here for only one reason - to get you the best deal. We are sure to have a solution for you from our panel of almost 30 reputable lenders offering hundreds of different car loans.

Apply online or over the phone and we’ll handle the rest

CarLoans.com.au has taken the hassle out of getting a great value car loan. Our simple four step process saves you time and puts you in the driver’s seat faster.

-

Apply online or over the phone and tell us your story.

-

-

We’ll find you the best loan.

-

-

We handle the application and settle on your behalf.

-

-

Pick up your car and drive away!

This is why we do it

We love helping people buy a car. It’s what drives us. Don’t take our word for it - see what our customers have to say!

Great service

STEPH S.

27 Mar 2024

Customer Service

CHRIS C.

29 Feb 2024

Fantastic service

ITA I.

27 Feb 2024

OUR PARTNERS

FINANCE

Don't be

fooled by 0%

Relying on the car dealer for finance exposes you to a raft of other costs and weakens your bargaining position. Do you really think the dealer giving you the full finance picture? Don’t be fooled by the 0% interest rate. Nothing is for free.

Frequently asked questions

How do I apply for a car loan?

|

Applying for car finance is easy with CarLoans.com.au. You can apply over the phone or apply directly online. All you’ll need to do is fill out details including the loan amount, the make and model of the car you'd like to purchase and some basic employment and income information - we’ll take care of the rest. Our expert car finance brokers will find the best loan to suit your needs and guide you through the process from application to settlement. Then, all you need to worry about is picking up your new car! |

How much can I borrow for a car loan?

For most lenders, the minimum amount you can borrow for a car loan is $5,000. Many lenders will allow you to borrow up to 100% of the vehicle’s purchase price, however other factors like your income, employment history and credit score can affect your borrowing capacity.

Am I eligible to apply for a car loan?

|

Eligiblilty requirements for a car loan include:

|

What do I need to apply for a car loan?

To apply for a car loan, the main documents and information required usually include:

-

Personal information and identification

-

Proof of income

-

Proof of assets and liabilities

-

Information about your car and insurance.

How long does the car financing process take?

At CarLoans.com.au, our car loan brokers can help get your car finance approved and settled in less than 48 hours, depending on the information in your application and the type of vehicle loan you apply for.

Can I get a car loan with bad credit?

Yes, we work with a variety of lenders to help borrowers with a poor credit history to find an affordable car finance option suited to their needs.

Can I get a car loan for my business vehicle?

|

Yes, there are a range of financing options related to business car loans including chattel mortgages, leasing, and equipment financing, and each come with a range of benefits. To be eligible for a business car loan the vehicle must be used for business purposes. |

What’s the difference between a secured and unsecured car loan?

A secured car loan uses the vehicle as security against the loan amount you borrow. If you fail to make your repayments, the lender can sell the asset to recover any lost proceeds.

In contrast, an unsecured loan does not have any security attached to it. Because of this, unsecured car loans typically come with higher interest rates and potentially fees as they are riskier for the lender.

What is a comparison rate?

|

A car loan comparison rate simply shows the true cost of the car loan. It considers the interest rate plus all fees and charges you’d need to pay on the loan. |